Egypt

A classic case of an overpopulated country, with a currency crisis and major geopolitical threats

Overpopulation

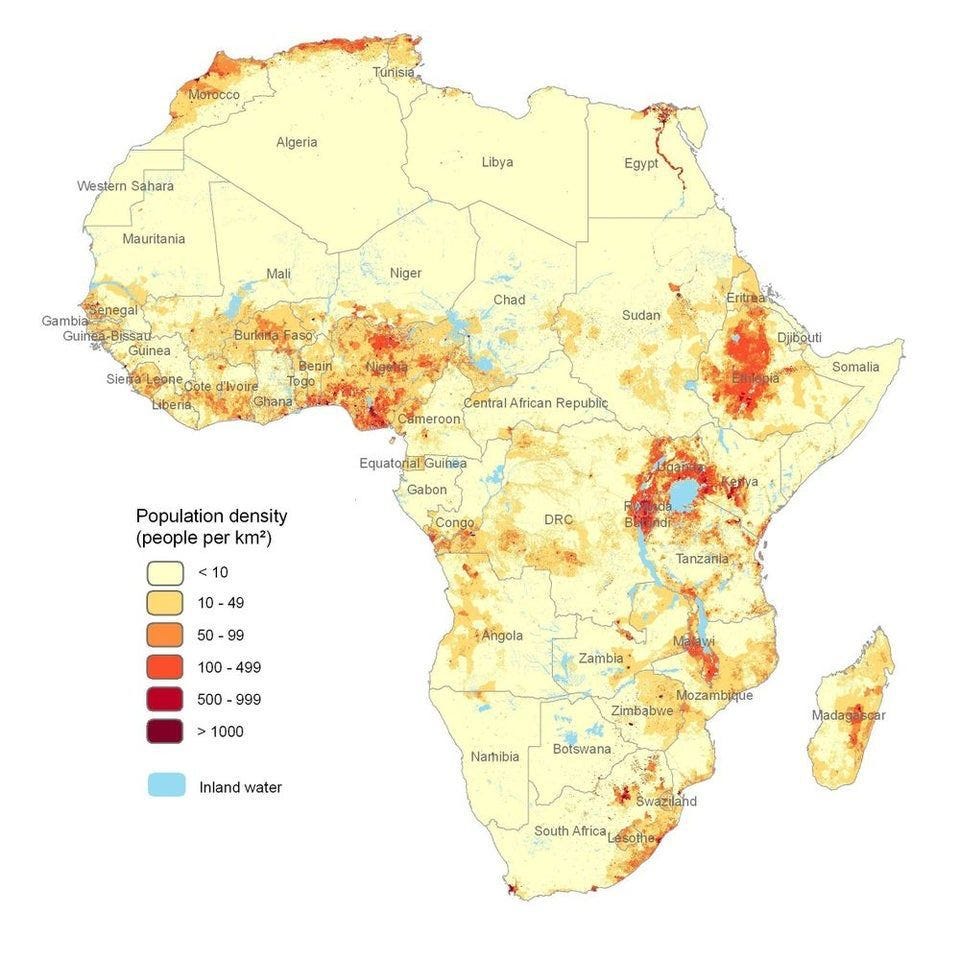

With about 110 million citizens, Egypt is the most populous country in the Middle East, and the third most populous in Africa.

Governments come and go in Egypt, but the country’s economic situation is much more defined by the demographic process of overpopulation, than by any economic policy governments attempt to implement.

Egypt’s population dynamics demonstrate an exponential increase.

We tend to forget this dimension. Egypt’s population during colonial times was in the range of 5-10 million people, no more than an average small European country today. As late as in 1953, when the Egyptian Republic was declared, the population was still no more than 23 million. Since then, it has more than quadrupled, to around 110 million.

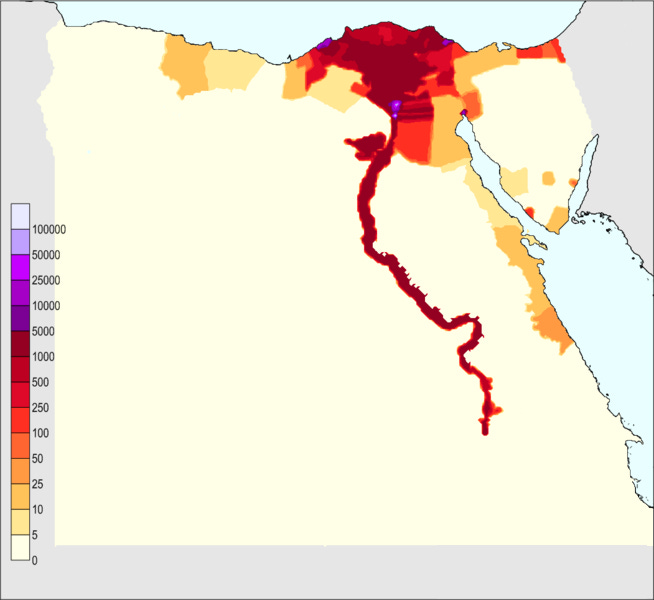

On top of all this, this gigantic population is confined to the close vicinity of the Nile river, the only fertile area of the country. The rest is infertile desert. However, this inhabitable area is no more than about 6% of the entire area of the country.

The consequences of this overpopulation are manyfold.

First of all, there is not enough housing. People live in makeshift houses, often building new levels illegally on top of high rise buildings, some of which collapse.

Secondly, there are not enough jobs. Each year the pool of young would be workers increases by around 4%. The economy simply does not grow at this rate.

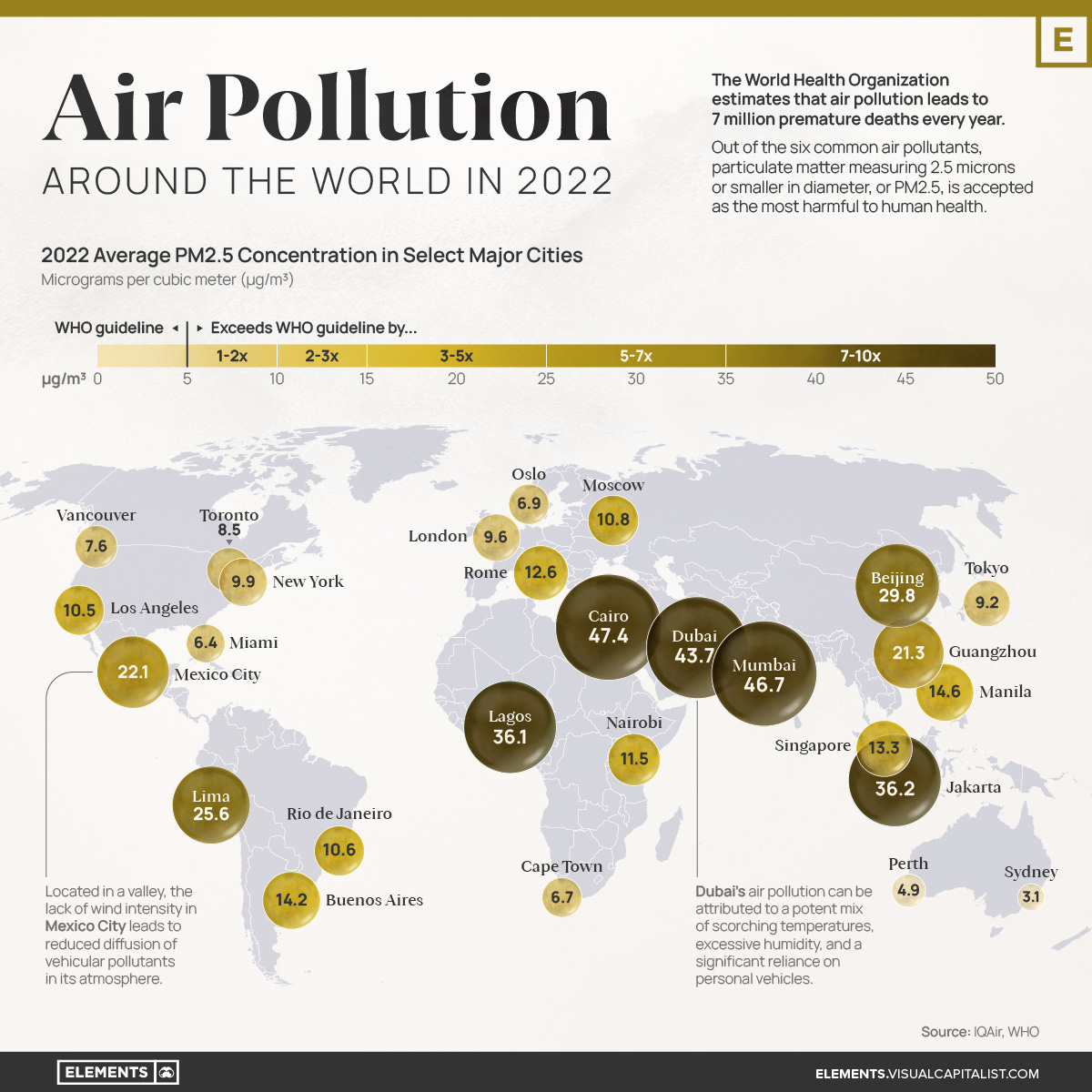

Thirdly, infrastructural development cannot keep up with the enormous population. Traffic jams are eternal, exhaust pollution terrible, public transport extremely inadequate, pavements almost non existent. Double or even triple parking in urban areas is the norm.

Fourthly, environmental degradation is terrible. Rubbish collection is clearly inadequate. The Nile as an ecosystem is all but dead. The air quality in the gigantic Cairo-Alexandria conurbation is terrible, with critical measurements a number of times above benchmark levels.

Many African states face similar problems of overpopulation. Having such a gigantic capital city, with no rural countervailing centres, is a typical third world phenomenon.

The newly expanding seaside resort areas do not create significant population centres. Wages are low, and as a consequence it is mostly seasonal male workers who find temporal employment, who then return to their families in their mainland. It would be economically unfeasible to bring them along and resettle permanently.

Re-traditionalisation

Rural, more conservative families have continued to have more children than urban, more secular ones. This has lead to a reislamisation and retraditionalisation of society, after a brief period of Westernisation and modernisation in the middle of the 20th century.

Re-traditionalisation does not mean that national heritage is well respected. Physical buildings - be them ancient Egyptian or Islamic - are often crumbling under the weight of overpopulation. Whenever you see such buildings renovated, it is often financed by some outside source, such as Germany, Austria, Japan or the European Union.

About 1/5 of males and 2/5 of females still cannot read and right. The elementary school system is very poor. Middle class families pay for private schools and private tutors.

Currency crisis

Argentina and Turkey are the two countries that are most often mentioned in relation to a currency crisis. However, Egypt is also on the verge of one.

The current official exchange rate of the Egyptian pound to the dollar is about 1:31-33. However, the black market rate has reached as high as 60. This means that sooner or later the government will be forced to devalue, which will greatly increase import prices. This might in turn cause an extreme situation for the very large impoverished segment of society. This has forced the government to implement a 50% increase in the value of the minimum wage in March of 2024. This is meant to offset increases in the price of essentials, part of an economic stabilisation package.

Speculation abut the currency crisis has forced the Egyptian central bank to implement a massive, 200 basis points increase in the interest rate, to a very high 22% level. Inflation stands at 29%. The IMF wants Egypt to shift to a free floating exchange rate.

Update: at the beginning of March 2024, the Egyptian Central Bank devalued the EGP to 50 against the USD, and raised the interest rate by 600 basis points to 27.25%.

Tourism

Tourism is a major source of foreign currency for Egypt. The number of arrivals dropped off during the Arab Spring period and the turbulence that followed. However, since President Sisi had stabilised his rule, tourists are gradually returning to Egypt.

2023 saw 15 million arrivals again.

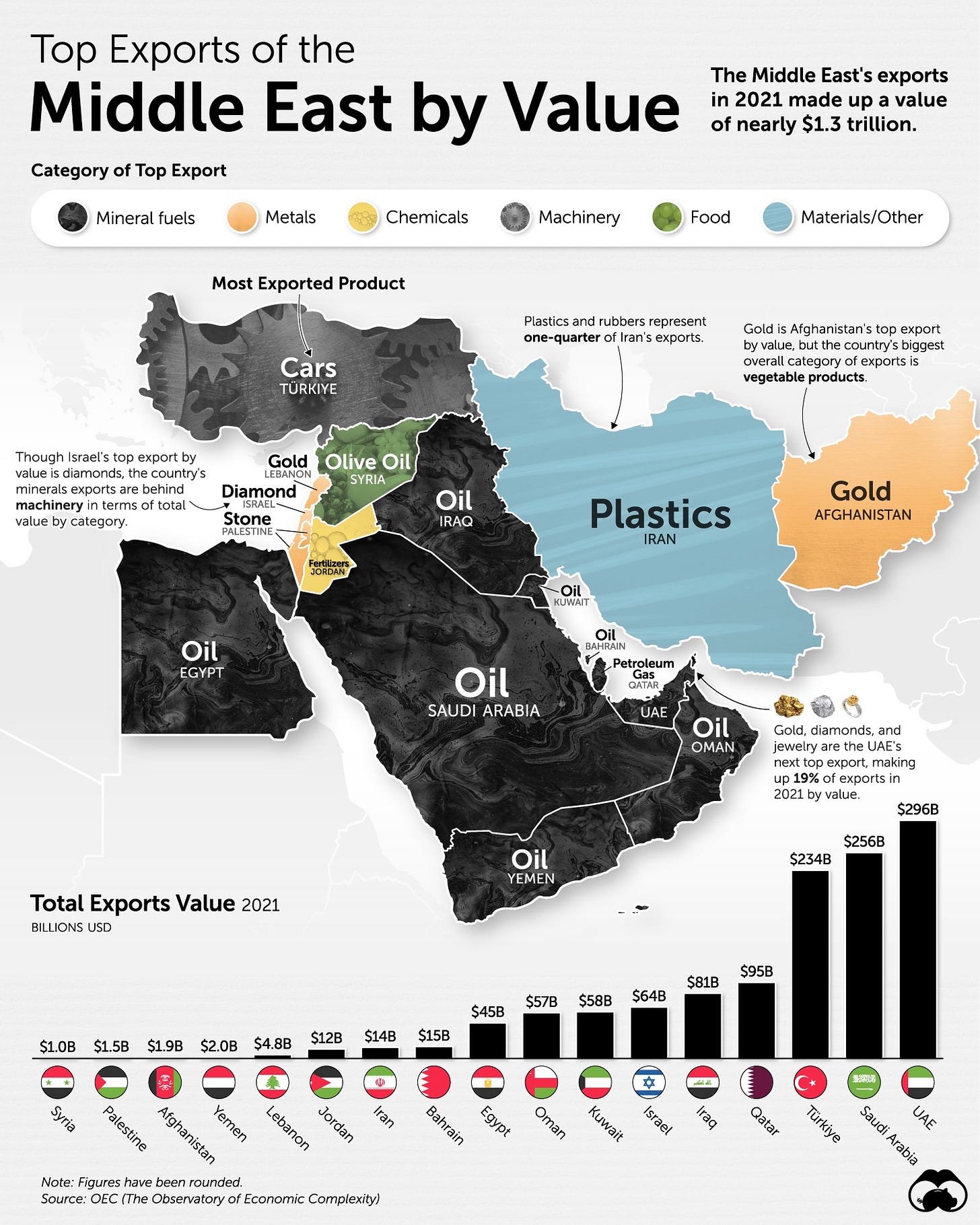

Egypt is an oil producer, but a gas importer

People usually do not think of Egypt as an oil producer, but it is. Obviously not at the same level as the Gulf, but still.

On the other hand, Egypt imports natural gas.

The state is still a major employer, employing some 4/10 Egyptians, not including the military, which is also a major provider of jobs.

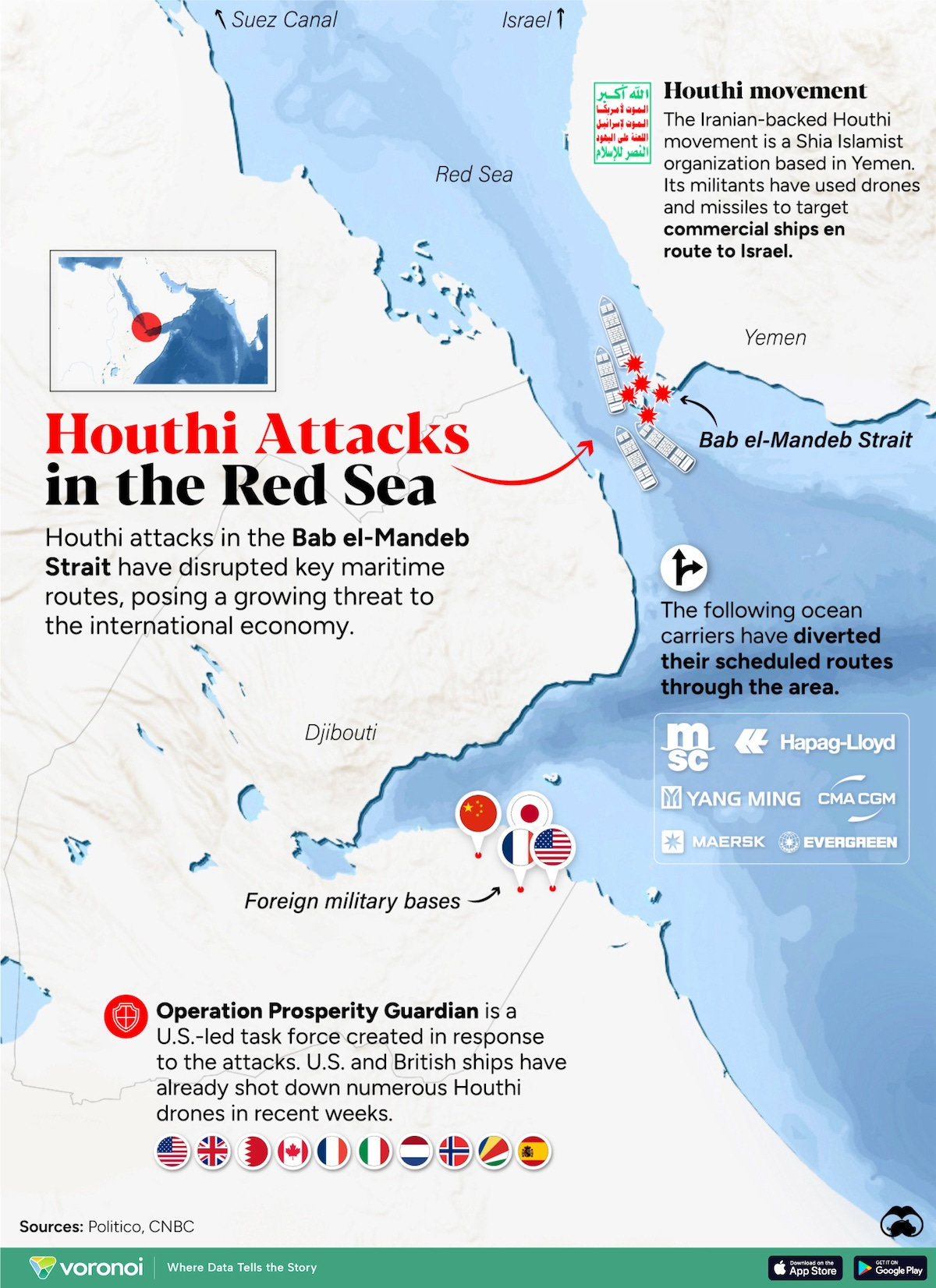

Geopolitical threats: Gaza and the houthis

The Gaza Strip is pretty much destroyed. Two million Palestinians have nowhere else to go, but to break through to Egypt. This is likely to severely destabilise Egypt, which already has a sizeable Palestinian population.

For a more detailed map go to the original source at the Guardian.

The two million new arrivals, many of them armed, are likely to continue their struggle against Israel, drawing Egypt into the conflict. Egypt currently keeps the Rafat border closed, and is not allowing Gaza residents into Egypt, especially because they fear Hamas, which is part of the Muslim Brotherhood network. Former Egyptian president Morsi, whom current president Sissi overthrew in a coup, had also been part of the Muslim Brotherhood network.

Since the beginning of the Gaza conflict, Israel has also closed gas exports to Egypt from the Tamar gas field, off the coast of Gaza, to Egypt. This has hit Egypt hard, as Israel has been a major source of gas imports for the country.

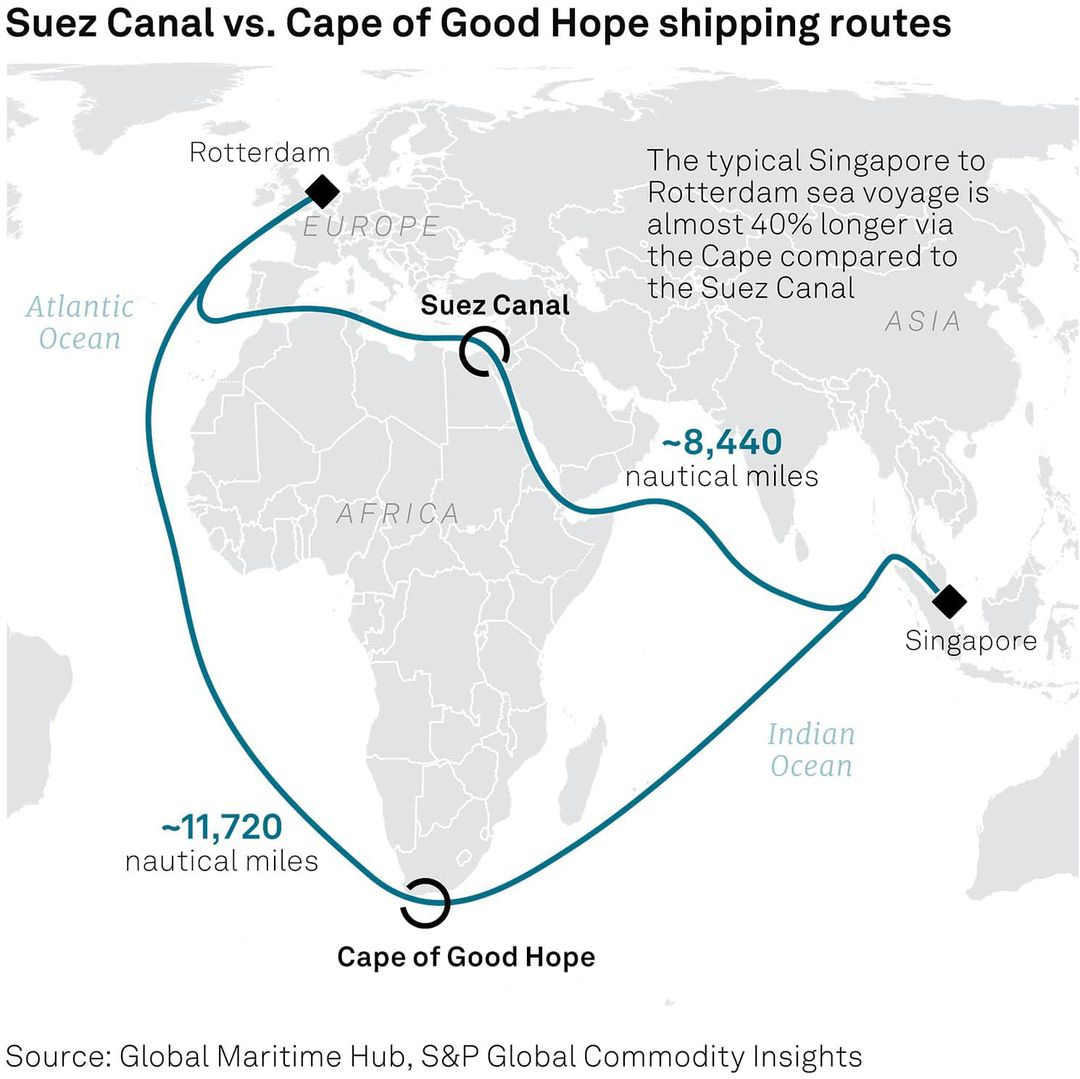

Egypt’s economy is badly affected by the houthi issue as well. Egypt is losing badly needed foreign currency revenue due to commercial shipping avoiding the Suez canal, a key source of foreign currency for the country.

The climate crisis

What Egyptians do not see as a major threat, interestingly, is climate change, which is in fact a major threat for them.

Tobacco usage

Half of men smoke in Egypt, but - being a Muslim society - almost no women.

Book recommendation:

If your liked this substack entry, subscribe now.