The Economist has recently branded Germany the sick man of Europe. Although this term gets thrown around a lot, it is still worth investigating the question.

The German economy has been in trouble since about 2017.

If we use real wages as a yardstick, the energy crisis 2022 has been the worst economic crisis in Germany since WWII. In 2022, the German inflation rate approached 1970s levels by far outpacing nominal wage growth, which led to the largest drop in real wages in German postwar history.

Germany is likely to reman in a recession in 2024.

The economic troubles of this major industrial power are manyfold:

an energy shock due to the Russian invasion of Ukraine,

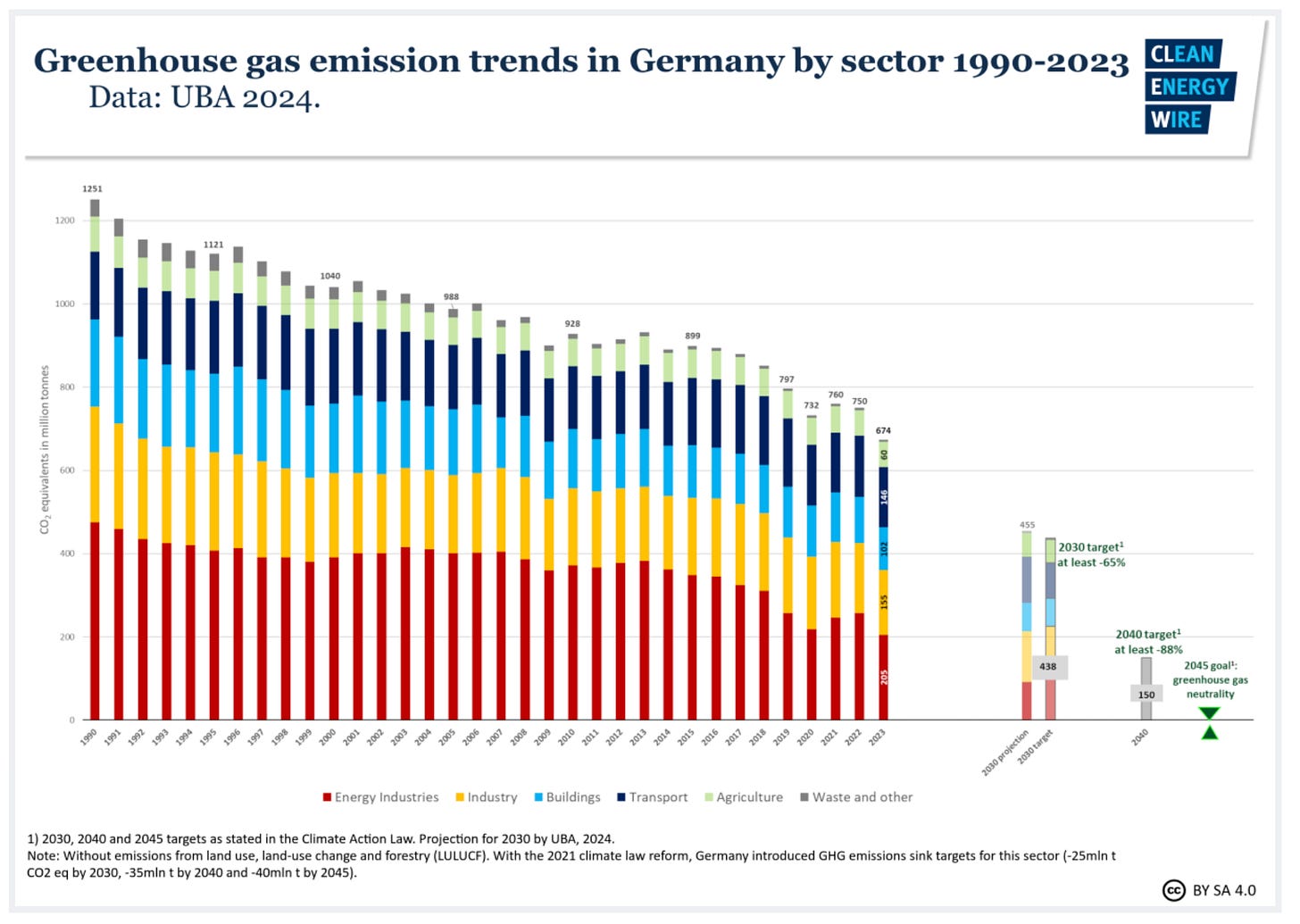

the not unrelated green energy transition,

China’s rise is turning what was in the past a market for German goods into an industrial rival.

The economic troubles are reflected in the low approval ratings for Chancellor Olaf Scholz.

There have been massive strikes in Germany recently (railways, airport workers, IG Metal, doctors, banks etc.) in a country that is used more to peaceful wage negotiations than to industrial action.

Energy prices

German energy prices remained higher than before the 2022 inflation wave.

A large part of the reason why user prices have stayed higher than market prices is because of the raising carbon dioxide prices (from €30 to €45).

US market prices remained much lower during the entire period. The European surge was mostly due to the fact that Europe had been importing much of its natural gas from Russia before.

The energy shock led to massive price increases (general CPI), especially in the case of food:

Higher energy prices hit the German economy hard, especially the energy intensive part of it.

Note that there would also have been some growth in these figures without the crisis, thus the loss is even greater. Note also that fiscal policy in 2022 was still expansionary, which dampened the shock effects.

Fiscal conservativism and the Schuldenbremse

Over and above this, there has been a self-inflicted wound – namely German fiscal policy. At 64% last year, the ratio of government debt to GDP is extremely low in comparison to most other countries. However, by law (the infamous Schuldenbremse) the German government is obliged to aim at something close to a balanced budgetOn top of the above shock, the German government insists on the “normalisation of fiscal policy”, i.e fiscal conservativism. The finance minister of the Ampelkoalition is from the liberal party (FDP), whose fiscal philosophy has always been tight fiscal policy. This insistence on tight fiscal policy is exactly what brought Adolf Hitler to power in the 1930s. In some sense history is repeating itself:

There has been open discussion in German media about the close links of the AFD with neo-nazi groups.

The leading partner of the coalition is the social-democratic party, which should use Keynesian countercyclical fiscal policy instead. This is exactly what the Biden administration has been doing in the USA (Infrastructure Act, Chips Act, Inflation Reduction Act, etc.).

Fiscal fundamentalism leads to a downward spin. Recession reduces tax revenues, the government attempts to balance the budget through a decrease in expenditures, which leads to an even worse recession, as reduced private demand is couple with reduced government demand. Basic Keynes.

If this was not enough, because of the Schuldenbremse rule, the government a) has eliminated electric car subsidies, which will slow down green transition and harm german car producers, and b.) is unable to transfer to the poorer part of the population the revenues from CO2 pricing, c) will not have enough money left for badly needed infrastructural modernisation.

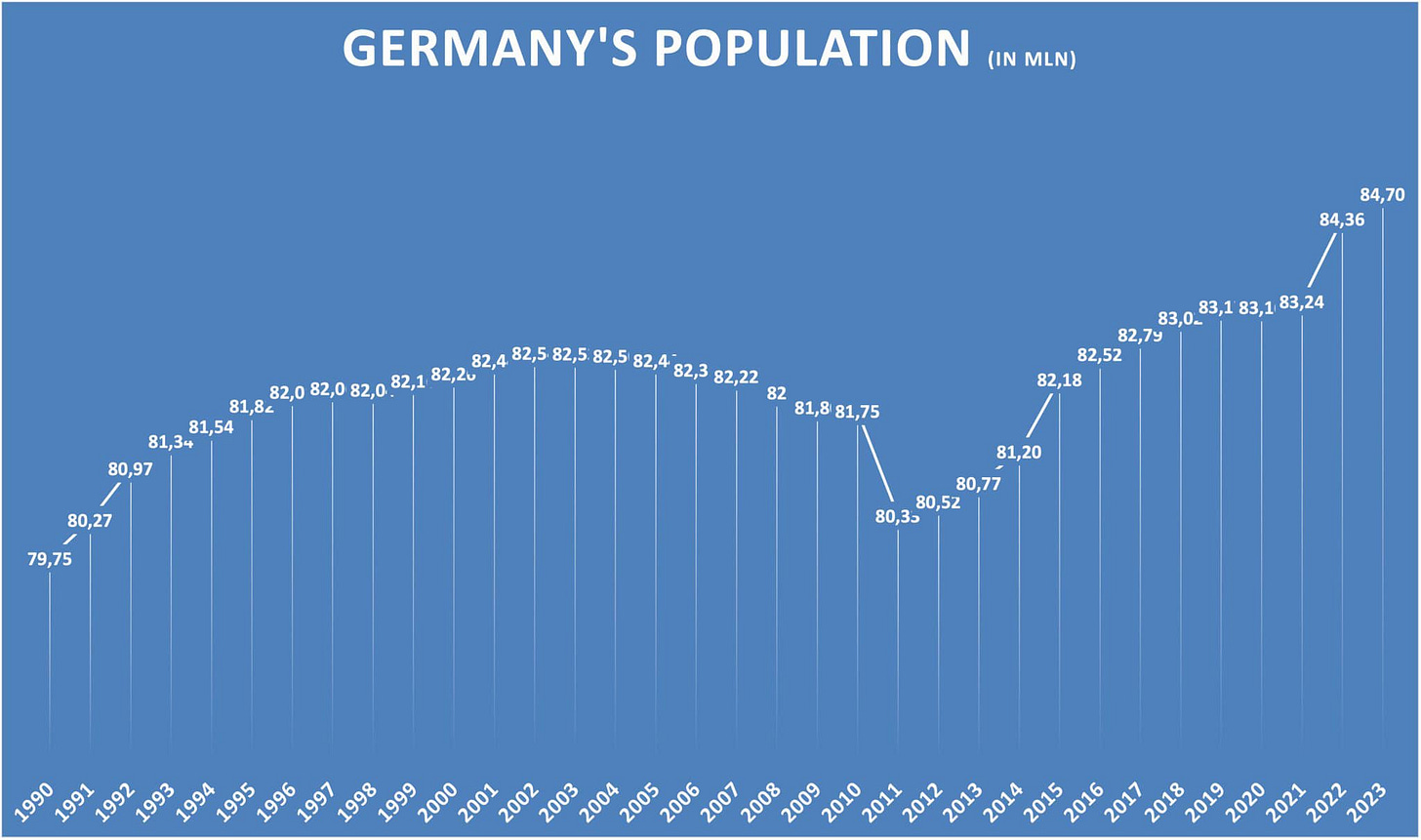

Demography

Demography is often touted as an underlying cause of Germany’s economic troubles. Howeever, Germany’s population has started to grow again. More Germans are still dying than are being born, but immigration still enables growth. Over a million Ukrainians, for instance, have now made Germany their new home after the Russian invasion.

Most of Germany’s population still lives in the major urban areas of former West Germany. Former East Germany is less populated, with the obvious example of the capital, Berlin.

The China challenge

German manufacturers once viewed China as the world’s largest market for their products. Chinese firms have since become their competitors globally, and the Germans are losing market share, especially in the car sector, traditionally vital for the German economy.

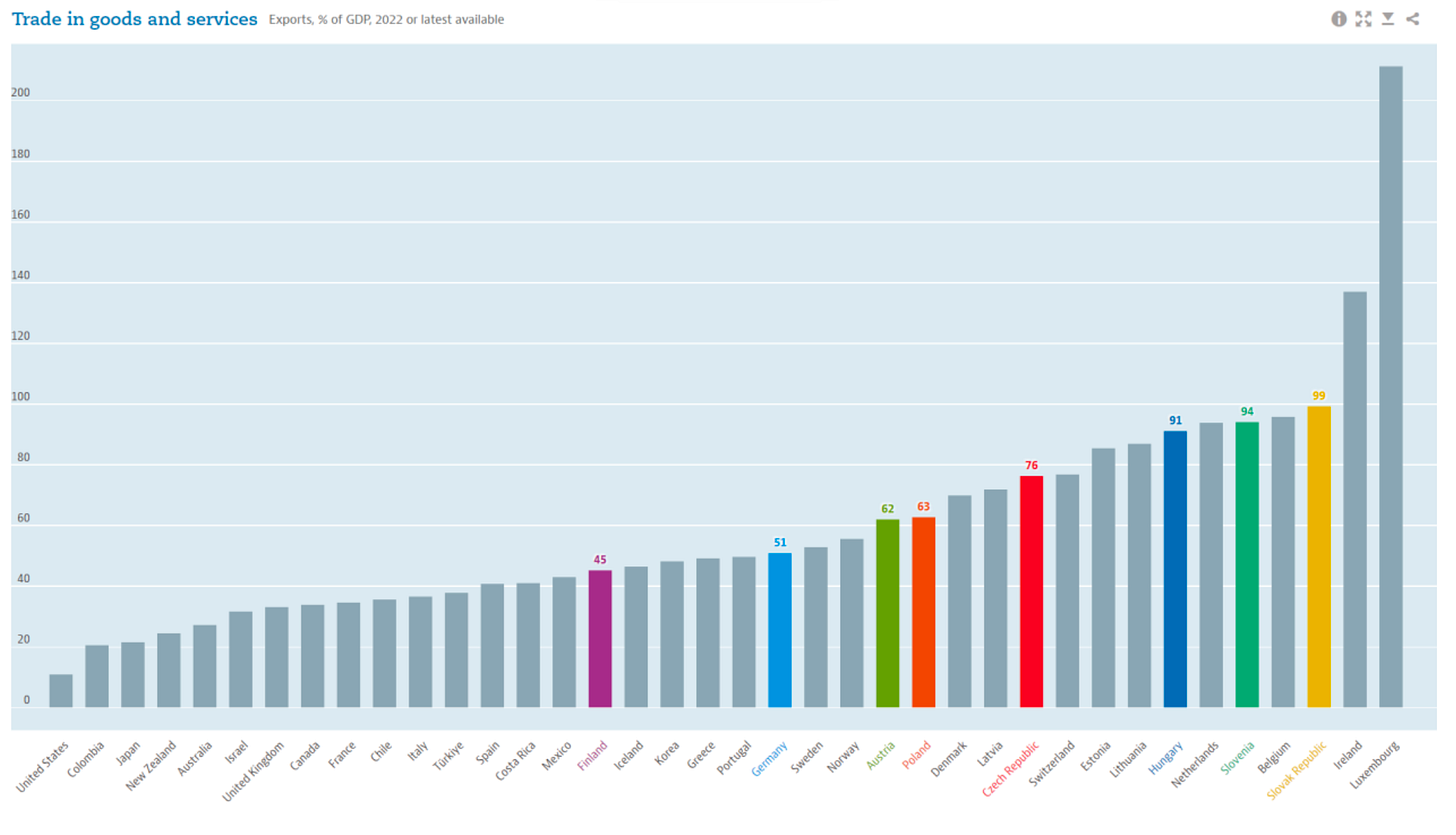

Germany’s ratio of exports to GDP, at 47 per cent, it is much higher than for France and the UK (29 per cent), China (20 per cent) and, particularly, the US (11 per cent). Manufacturing’s share in value added (19 per cent) is again much higher than in the US (11 per cent) and indeed more than double that in France and the UK (9 per cent).

In the electric car segments the dominance of China is even greater. Chinese battery producers are also dominant, they are even expanding to Germany (and Hungary) in order to supply the German e-car manufacturing segment.

Ageing infrastructure

The Merkel government’s fiscal conservativism meant that there was a sustained lack of investment into basic infrastructure, even though during those years the German government could have borrowed at negative interest rates! One example is the German railway system, once famous for always running on time. Now it is such a mess, that it has become the butt of jokes amongst Germans. Trains are late so often that the Germans have banned late German international trains from their system.

The same holds true for everything from internet and mobile speeds to highway congestions. Germany (like its European peers) suffers from a lack of digital platforms. A recent study by the Frankfurter Allgemeine Zeitung shows that the US accounts for 80 per cent of the global market value of such platforms; China has 17 per cent and Europe as a whole only 2 per cent.

Energy policy

Closing down nuclear power stations is often criticised, but the example of France (with its extreme external energy dependence on imported nuclear fuel) demonstrates, this was the right decision.

The carbon dioxide price has been raised in Germany from €30 to €45.

In a bid to avert gas shortages due to the energy crisis fueled by Russia’s war on Ukraine, Germany temporarily reopened some recently decommissioned and other soon-to-be decommissioned coal power plants in 2022 and 2023. This likely resulted in more CO2 being released during a certain period, while Germany's total emissions and coal power use declined markedly in 2023, although part of this is due to the economy struggling. Seven lignite-fired power plant units with a combined capacity of 3.1 gigawatt will finally be shut down in Germany at the end of March 2024.

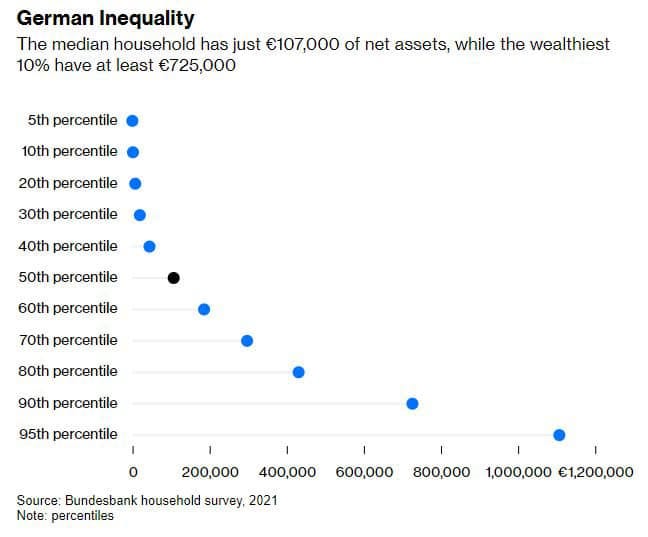

Inequality

Inequality also leads to a lack of demand, as wealth and income concentration leads to the rich being able to spend less than a more even distribution.

Germany is no longer the equal country that it once was

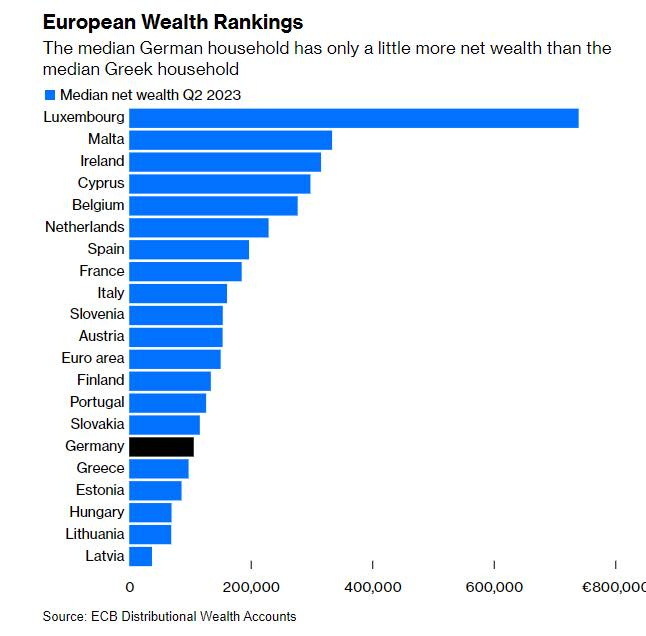

Germany is rich, but the Germans are not.

Book recommendations:

Precise overview of macro trends. The other components in my view:

1.low availability of digital services. All aspects of personal and business life are still excessively reliant on old, paper based processes, outdated software built in the late nineties. Just try opening a bank account or move to a new rental apartment. In large companies all digital initiatives ( e.g new software implementations) are hindered by the Workers Council's veto power or co-determination rights.At best old processes and privileges need to be maintained therefore software requirements are added making the project a lot more costly and lengthy.

2. No innovation in the middle segment. There is a strong university and academia scene where real innovation happens. Sadly this does not really feed into start-up business or small to mid-size companies, which could really take off and achieve unicorn status. Commercializing innovation and scale up production is a skill set that is currently lacking. Major industry players have their own innovation hubs but those are not developing radical new products or services. It's mostly refining their existing portfolio or updating products.

There is of course the macro problem as the primary issue. The US still gets the best immigrants - countries such as the Netherlands, Singapore or the UK mark a solid second tier in the brain drain race, while asylum seekers arriving in the Germany are clearly the rest of the bunch and not good enough to contribute much to such an advanced economy. Th upfront cost of integration and education is so high that an increasing population is going to take decades to materialize as a positive economic effect.

Another Germany-specific issue is the German management style. French business schools are top tier and churn out a solid supply of professional business leaders - neighboring Germany has nothing like that. Sunk cost fallacies, family members promoted to the board or spending corporate funds on personal comfort are the norm. For decades it was the state guiding around the business sector with a carrot on a stick, while the German C-suite contributed next to nothing. It's really the skilled labour and state incentives (and industry lobby groups) carrying German firms on their back. With increased tensions in the labour market this setup is now backfiring. It would be logical to replace labour with energy/automation, but oh...

...One thing to salute Germany for is that they were the first developed country to move away from having a dirty grid towards a greener future. Except they did not solve the energy trilemma - that green future is expensive and both German consumers and the corporate sector has to pay a premium on electricity. So the only thing that could provide Germany a little boost in the current tough situation (cheap energy) is forbidden by German and EU laws.

At the end of the day the Germans are lucky though, as after Brexit they are the solid leaders of the EU and their economic supremacy isn't threatened by Italy, Spain or France. The ECB will once again bend the interest rates in Germany's favour and the new EU Commission is likely to keep German economic interests safe.